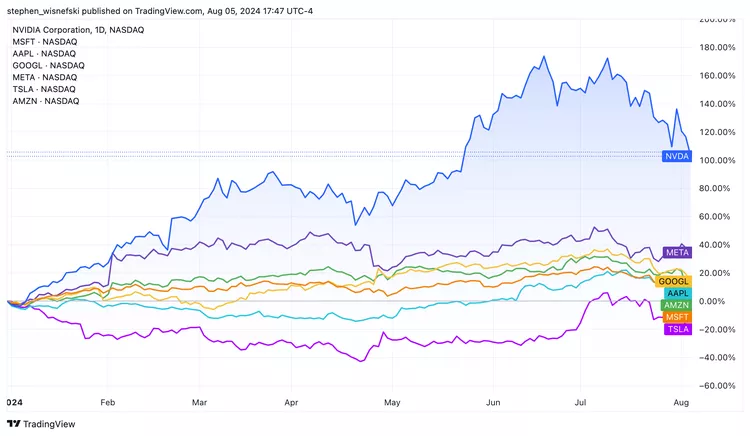

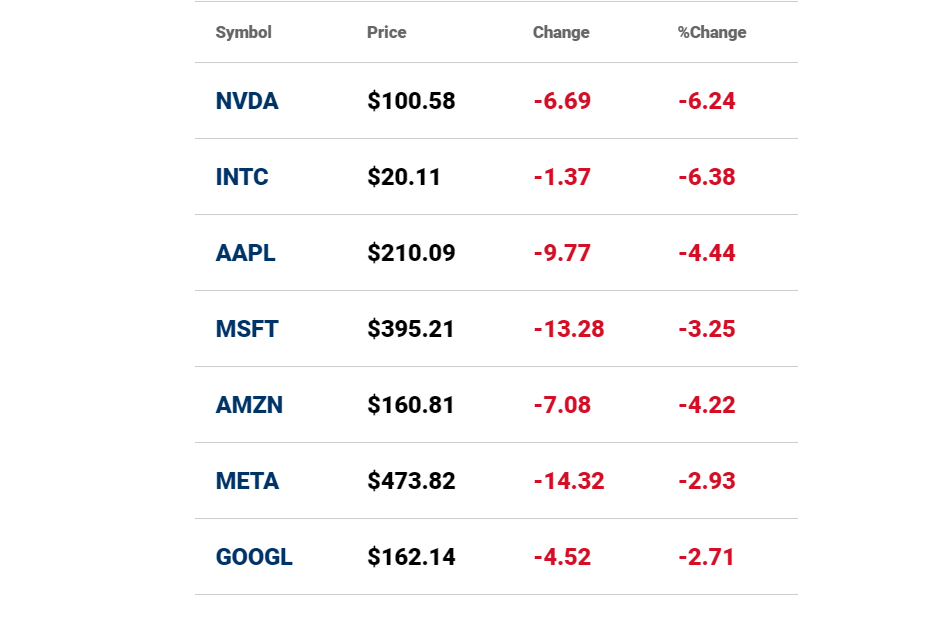

U.S. Stock Market Loses $2.12 Trillion as of August 5, 2024: A Comprehensive Analysis

In a dramatic turn of events, the U.S. stock market is experiencing a massive decline, with a staggering $2.12 trillion wiped off the total market capitalization. This sharp drop highlights the volatility and rapid shifts that can occur in financial markets. Here’s a detailed breakdown of what happened, the factors contributing to the decline, and the implications for investors.

Market Overview: The $2.12 Trillion Drop

Over the past week, the U.S. stock market saw a significant decrease in its total value. As of August 5, 2024, the total market capitalization of U.S. stocks was approximately $49.2 trillion. The market’s recent decline of approximately 4.3% resulted in a loss of:

- Total Market Capitalization Loss: $2.12 trillion

1. Breakdown of Major Indices:

S&P 500:

- Previous Week’s Market Cap: $39.6 trillion

- Weekly Decline: 4.2%

- Dollar Decline: Approximately $1.67 trillion

Nasdaq Composite:

- Previous Week’s Market Cap: $26.7 trillion

- Weekly Decline: 5.0%

- Dollar Decline: Approximately $1.34 trillion

Dow Jones Industrial Average (DJIA):

- Previous Week’s Market Cap: $10.9 trillion

- Weekly Decline: 3.8%

- Dollar Decline: Approximately $0.41 trillion

The combined dollar declines from these major indices contribute to the overall market loss, reflecting the broad-based impact across various sectors and stocks.

Key Factors Contributing to the Decline

1. Economic Data and Corporate Earnings:

The week was marked by disappointing economic indicators and weaker-than-expected corporate earnings reports. Companies across various sectors reported slower growth and lower profits, which fueled concerns about the broader economic outlook.

2. Geopolitical Tensions:

Heightened geopolitical tensions and uncertainties contributed to market volatility. News related to trade conflicts, regional disputes, and international policies created an environment of uncertainty, leading to investor sell-offs.

3. Regulatory Concerns:

New regulatory proposals and increased scrutiny on various industries added to market apprehensions. Anticipated regulatory changes and potential new compliance costs led to a negative reaction from investors.

4. Broader Market Trends:

The decline was part of a broader trend of financial market instability. Global economic conditions, including fluctuations in foreign markets and changes in economic forecasts, also played a role in the overall market decline.

Implications for Investors

1. Increased Volatility:

The recent drop underscores the volatility of the stock market. Investors should be prepared for rapid changes in market conditions and consider strategies to manage risk.

2. Diversification and Risk Management:

Diversification remains crucial in times of market downturns. Investors should assess their portfolios and ensure they are diversified across various asset classes to mitigate potential losses.

3. Long-Term Perspective:

Despite short-term declines, maintaining a long-term investment perspective can help investors navigate through market turbulence. Long-term growth prospects and underlying fundamentals remain important factors for investment decisions.

4. Staying Informed:

Keeping up with market developments and understanding the factors driving market movements is essential. Investors should stay informed about economic indicators, geopolitical events, and regulatory changes that may impact the market.

Looking Ahead: What to Watch For

1. Economic Data Releases:

Upcoming economic reports and corporate earnings announcements will provide further insight into the health of the economy and potential market directions.

2. Geopolitical Developments:

Monitoring geopolitical events and their potential impact on the global financial landscape will be crucial for anticipating market movements.

3. Regulatory Changes:

Stay updated on new regulatory proposals and their implications for various sectors and industries.

Conclusion

The U.S. stock market’s loss of $2.12 trillion last week is a stark reminder of the inherent risks and volatility in financial markets. By staying informed, diversifying investments, and maintaining a long-term perspective, investors can better navigate these challenging times and make strategic decisions to manage their portfolios effectively.

If you have any thoughts or questions about the recent market decline, feel free to share them in the comments below!