Investor Fear Surges: A 172% Jump in Fear Levels Before Monday’s Trading

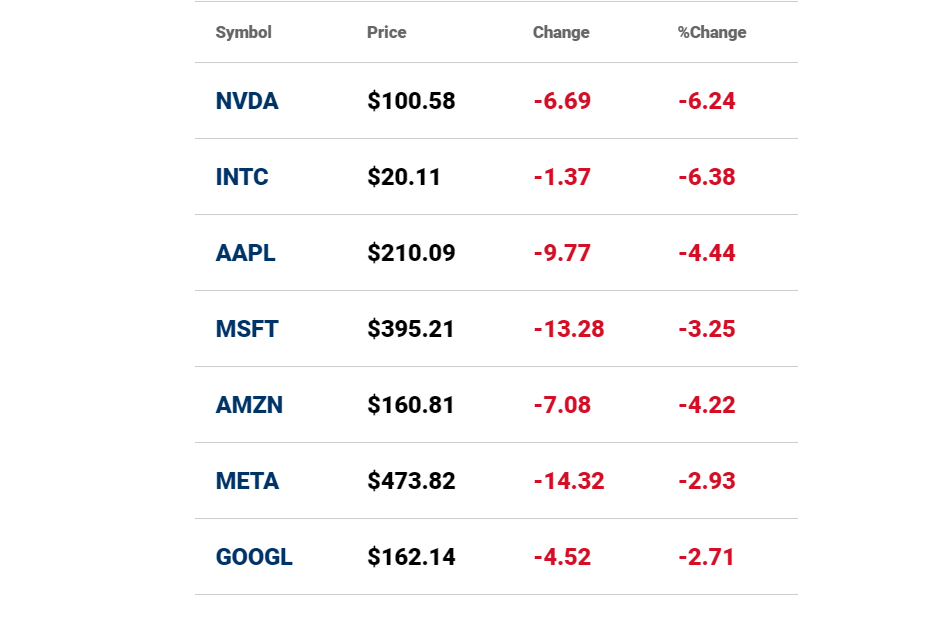

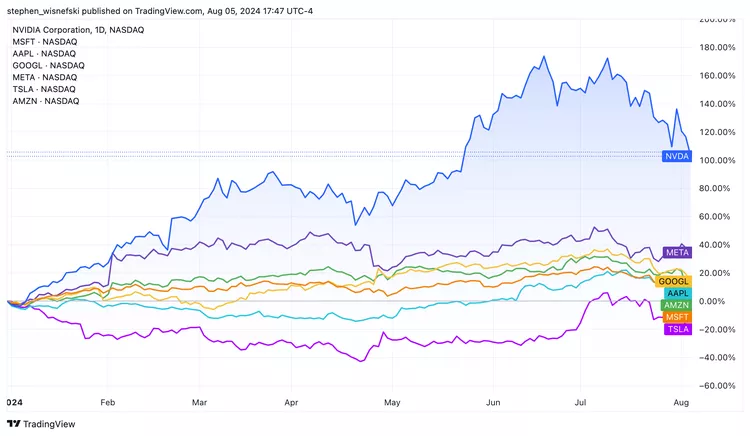

In recent days, financial markets have witnessed an unprecedented spike in investor anxiety. Fear among investors surged by an astounding 172%, reaching a fear index level of 62.27 before trading opened on Monday. This dramatic increase reflects heightened concerns and uncertainties within the market. But what’s driving this surge in fear, and what does it mean for investors?

Understanding the Fear Index

The fear index, commonly known as the Volatility Index (VIX), measures market expectations of near-term volatility. It is often referred to as the “fear gauge” because it reflects investor sentiment and market uncertainty. A rising VIX typically indicates increased anxiety about market instability, while a lower VIX suggests a more stable market environment.

The 172% Surge: What Happened?

Before Monday’s trading session, the VIX experienced a remarkable 172% increase, skyrocketing to a level of 62.27. This is a significant leap from previous levels and indicates a dramatic shift in investor sentiment. But what’s driving this surge?

Key Factors Driving Investor Fear

- Economic Uncertainty

Recent economic indicators have been mixed, with inflation rates remaining high and interest rates climbing. This has led to concerns about a potential recession and its impact on corporate earnings and economic growth. - Geopolitical Tensions

Ongoing geopolitical issues, including conflicts and trade tensions between major economies, have added to market uncertainty. Investors are worried about the potential for these tensions to escalate and disrupt global markets. - Regulatory Concerns

Increased scrutiny and potential new regulations, particularly in the tech sector, have heightened investor apprehensions. The uncertainty surrounding regulatory changes can create a sense of instability and fear among market participants. - Market Volatility

Recent market fluctuations and sharp declines in major stock indices have contributed to a sense of fear. High volatility can erode investor confidence and lead to increased demand for safe-haven assets.

What Does This Mean for Investors?

The sharp increase in the fear index serves as a warning signal for investors. A high VIX suggests that the market is expecting significant volatility and uncertainty in the near term. For investors, this can mean:

- Increased Risk: Higher levels of fear and volatility can lead to increased risk in investment portfolios. It’s essential to assess your risk tolerance and consider diversifying your investments to manage potential losses.

- Opportunity for Caution: While fear can lead to market declines, it also presents opportunities for cautious investors. Reviewing and adjusting investment strategies based on current market conditions can help mitigate risks and potentially capitalize on market corrections.

- Focus on Fundamentals: In times of heightened fear, focusing on the fundamentals of your investments can provide a clearer perspective. Analyzing the financial health and long-term prospects of companies in your portfolio can help you make informed decisions.

Navigating Market Uncertainty

In times of increased fear and volatility, maintaining a disciplined investment approach is crucial. Here are some strategies to consider:

- Stay Informed: Keep up with market news and economic developments. Understanding the factors driving market movements can help you make more informed investment decisions.

- Review Your Portfolio: Assess your portfolio’s exposure to risk and consider rebalancing if necessary. Diversifying your investments across different asset classes can help manage risk.

- Consult with Professionals: If you’re uncertain about how to navigate the current market conditions, consider seeking advice from financial advisors or investment professionals.

- Focus on Long-Term Goals: Remember that market fluctuations are a natural part of investing. Keeping a long-term perspective and focusing on your financial goals can help you stay resilient during periods of uncertainty.

Conclusion

The recent 172% surge in investor fear, reflected by the VIX reaching 62.27, underscores the current state of market uncertainty. As investors grapple with economic, geopolitical, and regulatory concerns, staying informed and managing risk will be key. By understanding the factors driving fear and implementing strategic investment approaches, you can better navigate the challenges of an unpredictable market environment.

Stay tuned for more updates and insights on the latest financial trends and market developments. If you have any questions or comments, feel free to share them below!

Sampson Brobbey

For more in-depth analysis and financial advice, don’t hesitate to reach out to a certified financial planner or advisor. The content provided here is for informational purposes and does not constitute financial advice.